Building and sustaining brand loyalty in a post-COVID-19 world will require a strategy based on digital transformation and creativity

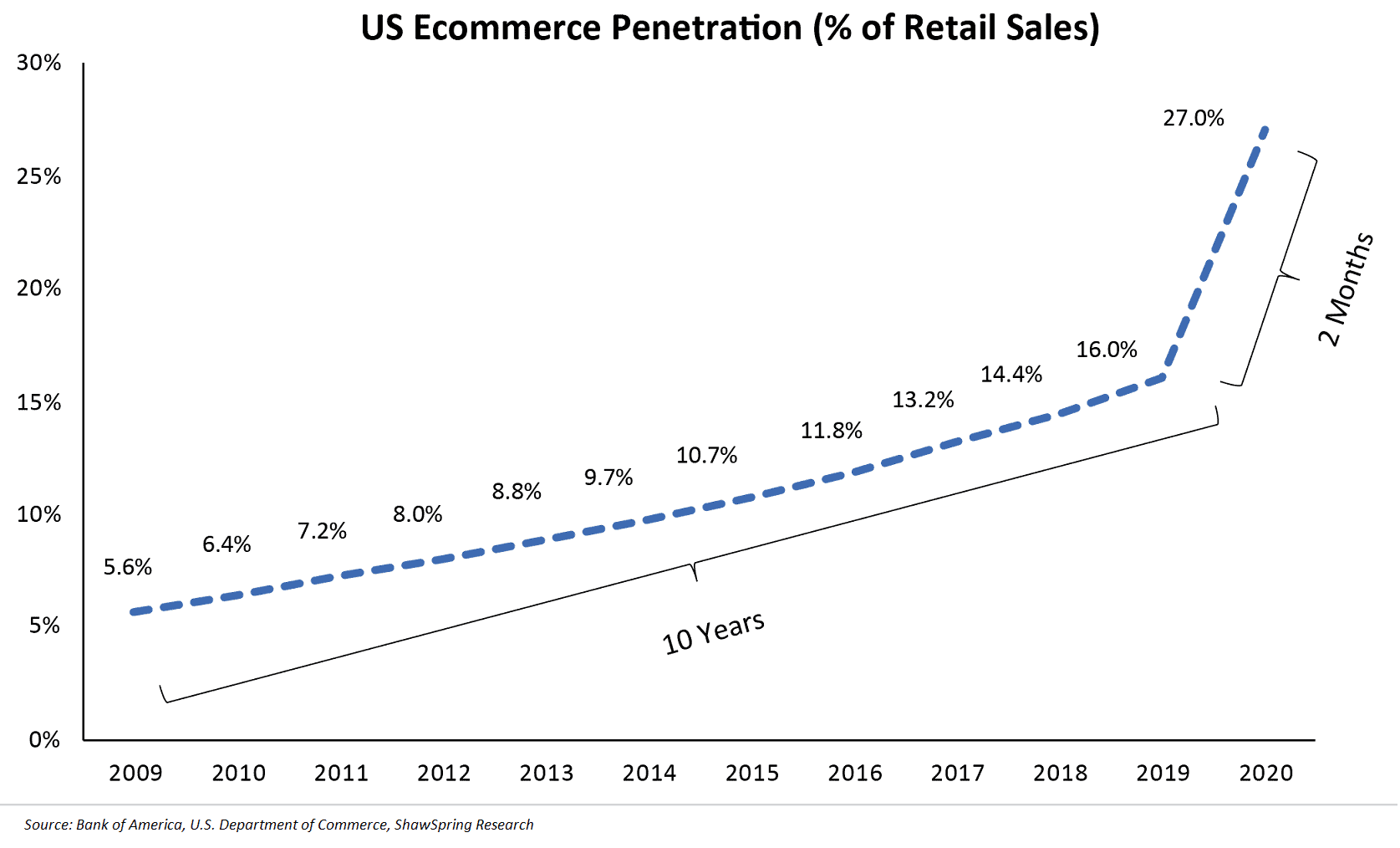

Long before the COVID-19 pandemic, brands faced numerous disruptions, including the rise of robust e-commerce platforms and tools, omnichannel marketing tactics, the use of analytics for data-driven decision making, automation, social media advertising and influencers, and many other facets of digital transformation. Now, the pressure to improve the digital experience has ratcheted up dramatically as many physical stores are operating at limited capacity to enable safer in-store experiences for employees and customers alike.

Some industry analysts believe that COVID-19 has permanently changed how we shop. Meanwhile, innovative companies are finding ways to adapt to the constraints of the times. No surprise: it involves digital solutions and aggressive new business models.

SHIFTING MORE ONLINE

The accelerated pace of digital transformation is likely to continue as retail markets ebb and flow as we continue to adapt to a pandemic landscape.

For brands, digital disruption means a variety of things. Some companies will need to focus on moving physical channels online for contactless shopping and delivery. Others will need to blend brick and mortar stores with digital channels to create an enhanced customer experience. According to research by McKinsey & Company, more consumers intend to continue to shop online even as the crisis subsides, with a portion of consumers shifting almost entirely to the online channel.

EVOLVING BUSINESS MODELS

Changing a business model can be risky but valuable if done correctly. A good place to start is to take a look at the habits and preferences of customers and prospects. Have they changed? What do customers and prospects want and need?

Customers have demonstrated that they want to access information about products and services while on the go, from their mobile devices. They respond best to personalization and consistent messaging, especially when the seller knows at what stage they are in the buying process as they move between phone calls, email, text, and the web.

How can brands tell where a customer is in the buying process? Data insights can be used to identify micro-moments (I want to know, I want to go, I want to do, I want to buy) and to tweak the marketing and creative to best move customers through the buyer’s journey.

Micro-moments were first identified by Google in 2015 as selling opportunities that have increased as more people use mobile devices throughout the day to communicate, check social media and news, watch and listen to entertainment, and shop. The move online has only increased since the pandemic, but loyalty is still in flux. According to research, 90% of smartphone users are not committed to specific brands before they start shopping online. Half of users have discovered and purchased a new brand when searching online.

Of course, creating an omnichannel marketing strategy must include e-commerce capabilities, which many smaller and mid-sized companies don’t typically focus on. Now is the time to do so.

One global retail chain with over 1,000 brick-and-mortar stores was able to launch an e-commerce site and log significant online sales in only 13 weeks. Enabling multiple channels to take advantage of micro-moments and online shopping platforms to close the deal is vital. But brands must do even more. Now is the time to be bold and experimental. Playing it safe risks losing ground to more savvy competitors or going out of business. Here are some examples of evolving business models and tactics that are proving effective during the pandemic and are likely to remain in place long after.

Direct to Consumer

Direct-to-consumer (DTC) retailing is a popular form of e-commerce that involves a direct transaction between a manufacturer and buyer via mobile and digital channels. The first generation of DTC businesses — like Warby Parker for eyeglasses, Everlane for clothing, and Casper for mattresses — made names for themselves by heavily investing in eye-catching branding and social media ads, selling directly to consumers through online stores and leveraging borrowed supply chains.

The second generation of DTC businesses has discovered the benefits of offering physical stores so customers can interact with merchandise and sales personnel. Bonobos is a case in point. The optimal equation appears to be offering customers a mix of both online and offline, with stores as another part of the omnichannel experience. Yet DTC is fundamentally about direct access through online ordering, so that channel must be marketing’s top priority.

Succeeding with a DTC strategy requires focus and resources. Online retailers adding a DTC plan should prioritize relationship building with individual consumers — perhaps even going so far as to include them in the creation of new products and services to increase revenue and loyalty. This collaborative approach has been called the “direct-with-consumer” model, which emphasizes using customer feedback to make product and service design decisions.

For example, award-winning design agency Gin Lane created Pattern Brands in 2019 as a multi-brand consumer goods company owned and operated under one roof which is committed to product development based on direct-with-consumer collaboration. The company’s first brand, Equal Parts, is a cookware line made from sustainable materials. Each purchase includes eight weeks of access to a cooking coach via text messaging. The current offer is already being fine-tuned with further input from consumers. One of them recently suggested that Pattern expand its add-on services to include easy-to-create grocery lists and pre-populated Instacart orders. This approach brings the conversation with customers about what they want much closer to the implementation of what they get. Pattern also recently launched Open Spaces, which is a home goods brand offering organizing essentials made from durable, responsibly-sourced materials.

Click & Collection

Click & Collect was on the rise even before COVID-19, especially among big-box retailers like Walmart and Target. While convenience was its initial draw — e.g. for busy, working parents juggling onsite client meetings, school pickup and grocery shopping all in one afternoon — Click & Collect took on a pivotal role in keeping customers safe and distanced from other shoppers at the height of the pandemic.

Even car dealerships now offer curbside pick-up and delivery options. Buyers can drop their old cars at lots and pick up their new, sanitized cars or get them delivered to their homes without any close human interactions.

Virtual Try-Ons and Virtual Stores

As the pandemic has kept consumers at home, L’Oréal, Kendra Scott and Suitsupply are among brands that have introduced virtual “try-on” tools to engage with shoppers. Maybelline’s website allows you to snap a photo of your face, upload it, and then apply makeup virtually.

This year, IKEA began testing a virtual store on the Alibaba e-commerce platform Tmall in China. You can move through a store on a PC or smartphone screen, view the merchandise in virtual room layout, and make online purchases.

Analytics and Automation

Another facet of digital transformation that continues to prove invaluable is advanced analytics. It’s now table stakes to use data to gain insights into customer behavior, which impacts products and pricing, supply chain optimization, and revenue forecasts. Gartner has observed that brands can keep up with consumer shifts by changing the way they measure and track marketing metrics to identify indicators of interest earlier in the customer journey.

Companies invested an estimated $3.4 billion in artificial intelligence in 2018 to enhance the shopper experience. Machine learning algorithms process data from focus groups, interactions, transactions, and polls to understand customer sentiment, guide recommendation engines, perform market basket analysis, and price optimization.

The North Face uses cognitive computing technology to ask customers questions about where they will wear specific clothing and what activities they’ll be engaging in to make personalized recommendations. Neiman Marcus offers customers an AI-driven app that lets them take pictures of clothing items they like and then the app searches the store inventories to find the items or similar ones. Uniqlo stores have AI-powered kiosks that measure customer reactions to products that are displayed on the screens based on matching brain signals to moods. The kiosks then recommend products based on the results.

Showrooming and In-Person Shopping

Wedding dress boutiques, for example, need a physical place to provide optimal experiences for customers. What does a safe, in-store shopping experience look like in a post-COVID world? The answer is evolving.

Some stores are adopting practices like showrooming (see offline, buy online) that have until recently only been offered by luxury brands. This would require consumers to make an appointment and limit the amount of products and people in the store to enforce social distancing and safety.

For products that require in-store visits, apps are being deployed that combine shopping lists with inventory checks, the length of wait times in lines, in-store layout navigation, and cashierless checkout.

STANDOUT BRANDS

Two companies getting it right during challenging and changing times are Vuori and Wine Access.

Vuori

Founded in 2015, Vuori produces men’s and women’s activewear. The company leveraged its five stores in California for local community events and gatherings, such as film screenings and art shows. Vuori was one of the first retailers to close its stores to protect employees and the community from the pandemic, even before the company was mandated to do so.

“The notion of doing what’s right, acting in a sustainable fashion and still doing great business fosters a sense of community and allegiance from our customers,” said Vuori founder Joe Kudla.

During the pandemic, Vuori has shifted focus to e-commerce and social media channels to stay connected to its customer base. Paying close attention to how consumers are adapting to social distancing, the company put extra sales and marketing resources into web and mobile experiences.

Vuori’s website now features a Journal page full of videos entitled, “The Rise. The Shine. Conversations” which includes interviews with athletes, environmental leaders, and other influencers. Now, every morning at 8:00 AM, Vuori offers free classes on Instagram Live from a different fitness instructor, yoga teacher, or mindfulness coach.

For the launch of its women’s clothing line in 2018, Vuori relied heavily on Facebook for advertising. It gathered a lot of data to understand its female customers and their interplay between shopping in-store and researching products online. This data has informed recent decisions to advertise in new channels like podcast advertising and paid search.

The company had planned for e-commerce sales to increase 100% year over year, but sales were up a reported 200%.

Wine Access

Wine Access has been at the forefront of the growing DTC wine sector and has differentiated itself through access to small-production, under-the-radar wines and by offering a multimedia customer experience online. Customers subscribe to the Wine Access email and then get daily access to multiple curated offers and the online store. The company claims its success is due to rich content plus great wine and that its value proposition has only grown during the pandemic, with restaurants and wine shops closed. No surprise, post lockdown the company has seen triple-digit growth and its Wine Club is fast growing.

The website features a blog series, articles, profiles of people in the viticulture industry, and an online store. In 2020, Wine Access launched a Facebook group, “The Wine Access Experience,” with live-streamed tastings and interviews with winemakers to discuss the challenges, art, and pleasures of their craft. The company is adding a podcast, hosted by a noted sommelier.

Wine Access was named “Top Online Wine Retailer” of 2020 by Wine Enthusiast. In a recent Newsweek article, the company was recognized in the list: “Best Wine Clubs to Subscribe to While Coronavirus is Keeping your Trapped Indoors.”

TAKEAWAYS

Digital transformation is accelerating and for brands it’s the key to a post-COVID recovery. Digital channels create the enhanced experience customers want and expect. Omnichannel strategies are proving highly effective. DTC models may well influence changes in how many brands market and sell. The time is ripe for creativity and innovation as market and demographic changes impact consumers in various ways. From virtual try-ons and micro-moments to analytics-driven insights and showrooming, successful brands are, as always, thinking out of the box and using the best tools available to them.