Investors may not possess a crystal ball or the ability to read tea leaves. However, what Norwest investors do bring is decades of experience in supporting businesses across the healthcare, enterprise, and consumer sectors. By closely monitoring these markets, they can anticipate impactful trends and make well-informed decisions.

Even with a global multi-sector, multi-stage perspective, our investors can’t foresee every development that might happen in the dynamic entrepreneurial landscape. At the close of 2023, who could’ve known that Indian quick commerce leader Swiggy would have the largest tech IPO globally in 2024? Or, that 2024 would see enterprise executives being used in deepfake attacks alongside politicians and celebrities?

Our investors’ deep experience with unforeseen market events and seismic innovations enables them to invest with conviction—and at this time of year, to make bold prognostications.

When asked about 2025, Norwest investment leaders responded with informed optimism rooted in their deep industry expertise. They see more opportunities to partner with innovative businesses across sectors and at all stages. Among other trends, they see solutions that will support better mental and physical health, and consumer-oriented apps that will make completing everyday tasks more efficient—and life a little easier.

Here’s what you can look forward to in 2025, according to our investment team.

Focus on Transformational Technology

Expect more guardrails to ensure that AI capabilities are focused on value-creating activities, and more investment to protect brands and modernize aging enterprise software.

AI systems will require a new QA role

Read Scott‘s blog post to find out how enterprises are bridging the gap to an agentic future.

Proliferating deepfakes will spur investment in security solutions

Learn more about the rising demand for deepfake security solutions from Dave‘s blog post.

Don’t be surprised by a surge of demand for enterprise software updates in industrial sectors

Dig into Ran and Chris’s thesis on software opportunities in tech-laggard industries.

Focus on Healthcare Innovation

Finding paths to improve health conditions will remain a top focus for healthcare startups and researchers. We focus on venture capital and growth equity investments across several healthcare verticals, and expect to see companies offer a broad range of medical devices and diagnostics, as well as tech-enabled services.

Neuroscience will be applied to more chronic conditions

Read how ShiraTronics, whose Series B funding Zack and the healthcare team led, is providing relief to chronic migraine sufferers through neuromodulation therapy.

New treatments for autoimmune diseases will gain traction

Learn how Nuvig Therapeutics, a portfolio company that Tiba and the healthcare team invested in, pioneered an innovative treatment for neuro-inflammatory disorders.

AI-enabled services will simplify revenue cycle management

Learn more about optimizing healthcare workflows from our portfolio company Infinx.

Look for breakthrough therapies in mental health

Focus on Consumer Behavior Shifts

Individuals will continue to seek out specialized services that boost convenience and overall well-being.

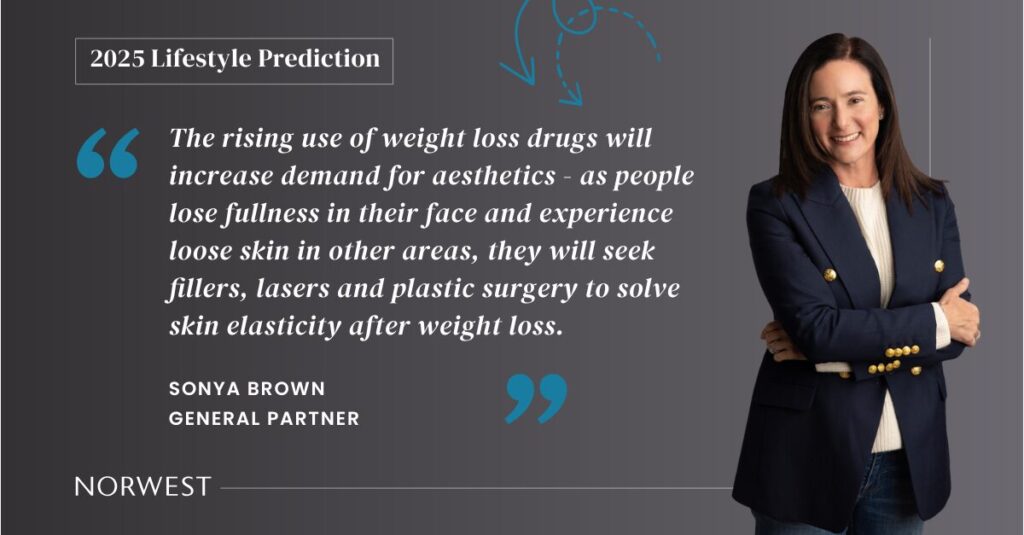

Weight loss drugs will increase demand for aesthetic services

Read more of Sonya‘s thoughts in the Beauty Independent article, The “Medicalization of Beauty”: Unpacking Skincare and Aesthetics’ Convergence.

Quick commerce in India is transforming consumer behavior and will grow as much as 2X

Find out how Niren and the Norwest India team partnered with quick commerce leader Swiggy to bring it from a delivery startup to the largest tech IPO globally in 2024.

Looking Ahead to 2025 and Beyond

Even as 2025 comes into focus, our team remains forward-looking. Predictions that don’t materialize in the new year may very well emerge just beyond the horizon. Fortunately, patience, courage, and conviction define our approach to everything else.

Before looking too far ahead though, take a moment to reflect on what made 2024 such a memorable year for all of us in the Norwest community.