Businesses today are experiencing a period of turbulence and uncertainty in the broader macroeconomic environment. Equity markets flirt with a bear market; U.S. inflation has been at the highest level in decades; individual and institutional investors are pulling back; supply-chain disruptions continue in several industries; and shockwaves from geopolitical instability is felt globally.

In this period of uncertainty, many founders and CEOs are asking, “What should I be focusing on?” Our answer is to concentrate on strengthening financial health and finding the right balance between growth and profitability.

While 2021 was largely a year in which investors valued growth at any cost, the attitude in 2022 is much different – growth, yes, but at a reasonable cost. And profitability should be an immediate objective, not a future promise.

Gusty Headwinds for Young Companies

For many young companies, the most significant impact of economic uncertainty is the potential for slower growth, or even a decline, in revenues. Enterprise customers, for example, may buy fewer new seats for SaaS products, or delay upgrades to products they already have. Prospective customers may think twice about taking on a new supplier, particularly one that may require carving out additional budget.

Young companies may find it difficult to raise additional capital, especially at terms comparable to those seen in previous years. Down-rounds can impact employee retention, and exit plans (through an IPO, acquisition, or merger) may have to be postponed.

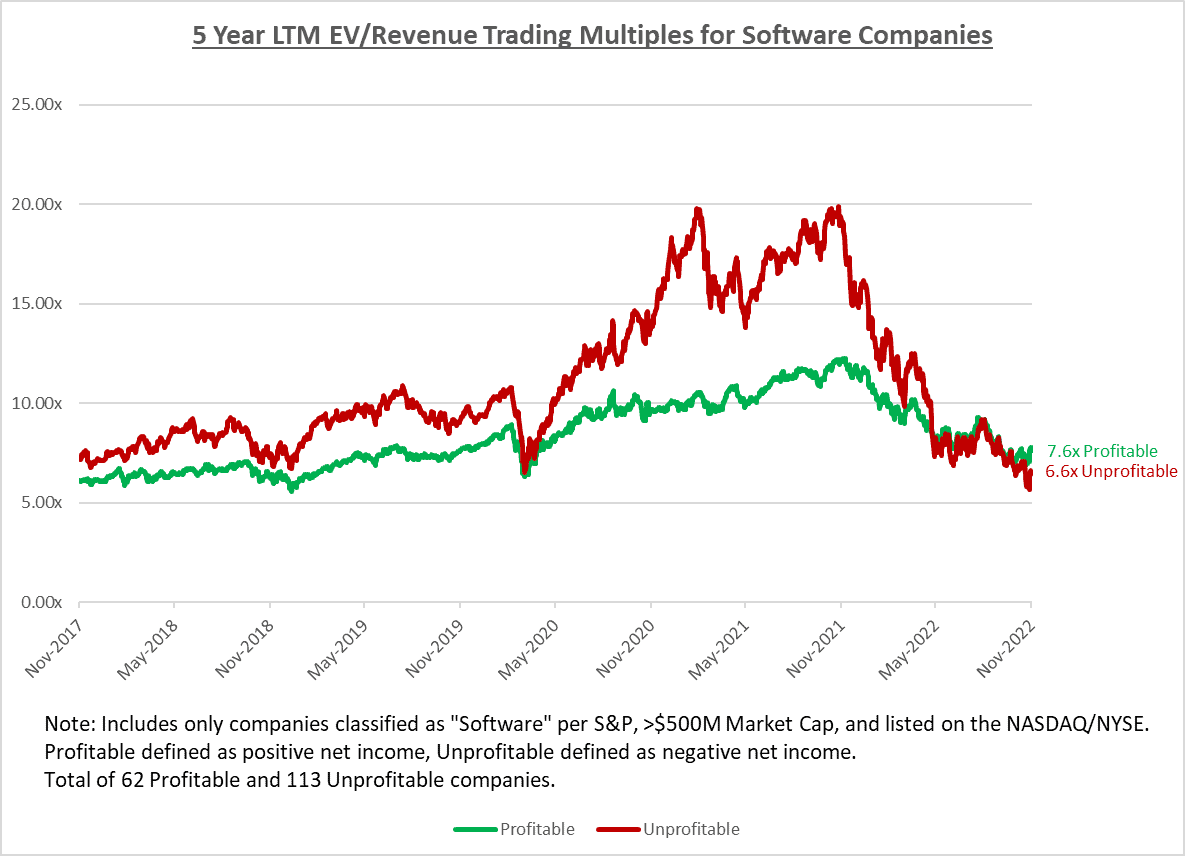

For most of the past two years, fast-growing but unprofitable software companies captured significantly higher valuations than slower growing but profitable counterparts. That premium for growth has now largely disappeared, with unprofitable companies now trading below profitable companies on average. The chart below represents the historical trading performance of software companies that are profitable versus those that are unprofitable.

The bottom line: Companies should focus on achieving both strong growth and profitability.

Growth and Profitability Are Not Mutually Exclusive

As growth equity investors, we look for companies that exhibit a strong mix of both profitability (and/or capital efficiency) and growth. We know why growth is important and what high growth tells you: a winning value proposition, a differentiated product, and a well-executed go-to-market strategy.

But why are profits important? First and foremost, profits matter because cash is king — companies go out of business when they run out of cash. Moreover, profits give you the freedom to chart your own strategic direction, not simply do what the markets dictate. And for a young company eyeing an exit strategy sometime in the future, profits will give you more control over timing, valuation, and options.

And profitability has several other potential benefits:

- Profitable businesses keep a keen eye on cash and know how to carefully manage spending, often coming up with creative approaches to operating efficiently.

- Profitability is a strong indicator of scalability. Companies that scale well are inherently efficient and able to drive operating leverage.

- Profits are often driven by desirable characteristics such as:

- high gross margins and a highly scalable business model;

- high-quality, “sticky” products and customer service that encourage customer loyalty, repeat business, and high retention rates;

- a company culture that values efficiency and cost control across all functions; and

- efficient spending on R&D to develop only the products and features that customers care about the most.

The most successful companies we partner with combine a visionary passion for solving problems for customers with a relentless focus on using cash wisely. The result is a desirable balance between growth and profits.

Moving the Needle Toward Profits

What can young companies do to achieve, or increase, profitability? Here are some best practices we recommend.

- Carefully make and monitor investments in new initiatives to ensure it is not a long-term drain on resources. Consider the whale vs. dolphin analogy. A whale dives deep underwater for a long time, while a dolphin skims the surface. A “whale” investment is an all-out commitment of resources before any indication of success. The risk and cost of failure are high. The more prudent “dolphin” investment approach involves spending lightly on a new product or initiative, so if the idea does not work out, the cost of withdrawal is minimal and the broader company is not put at risk.

- Focus on efficient topline growth. Make sure the payback on customer acquisition cost (CAC) is less than 24 months (ideally less than 12 months), and the ratio between the lifetime value of a customer and the CAC is at least 2x (ideally 3x+).

- Expand gross margins. Achieving your EBITDA goal starts with strong gross margins. There are multiple ways different departments can work to drive gross margin expansion, including:

- Ongoing enhancements to product features allow for higher pricing and better margins.

- Rationalizing or eliminating low-margin products and focusing the engineering team on automating processes that require manual intervention can make the product more self-serve and may lift margins by requiring fewer customer service resources for each account.

- The finance team can help negotiate technology or data partner spend to reduce input costs.

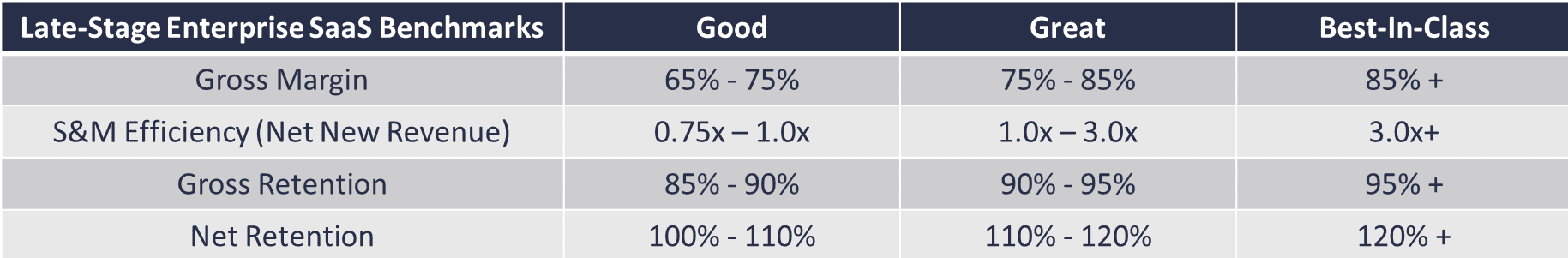

- Determine the KPIs and other metrics most relevant to your business and track them relentlessly. Some of the metrics we typically look for are:

- The Rule of 40 (a software company’s revenue growth plus profit margin is 40 or more)

- Sales and marketing efficiency (net new revenue divided by S&M spend)

- Gross dollar retention and net dollar retention

Other actions may be harder to measure but still can contribute to profitability. For example, recruitment costs can be lowered by creating a positive company culture that encourages productivity, retention, and longer tenures.

For other suggestions, see the case study on YipitData, where the CFO offers lessons from the front line on balancing growth and profitability.

Profitable Companies Control Their Own Destiny

By adopting proven practices such as the ones cited above, young companies can achieve or increase profitability and reap these benefits:

- attractiveness to potential growth-equity investors, acquirers and/or merger partners

- the freedom to raise capital on its own terms and schedule

- a stronger basis on which to plan exit strategies

- enhanced confidence among current and potential customers

- bolstered morale among employees

At the end of the day, a profitable company can control its own destiny.