“The bison have escaped and are heading towards the interstate. What should we do?”

Just two months before I was expected to have an answer for that pressing question, I was in private equity – far from rampaging bovine. I left that job to join a company in the regenerative agriculture space. As the CFO, I thought I’d be building spreadsheets, forecasting cash flow, and optimizing KPIs. Instead, I spent most of my time managing vendor relationships, handling HR issues, and performing real-world “risk management.” Which, in this case, involved deciding how to handle some loose bison. Not what I’d anticipated.

Long story short, after three years getting my butt kicked in the real world, I returned to Norwest with a newfound appreciation for just how hard it is to run a high-growth business. I also gained a deep respect for the value that a strong board can bring to a company… if it applies the appropriate perspective.

Norwest’s Invited Guest Approach

Today, I work on the Norwest Growth Equity team. We primarily invest in founder-led, profitable, growing businesses. These companies were successful before partnering with Norwest. They’d likely be successful without us. They choose to accept our investments because they believe we can help significantly increase the value of their businesses. This starts with honoring the legacy of what has worked while offering insights, resources, and a broad network of experts to assist in a handful of strategic areas.

We call this the Invited Guest Approach. Let me break it down from the perspective of someone who has been on both the operator and investor sides.

The Invited Guest Approach is not:

- Just being a friendly voice in the boardroom without any substance

- Being overly hands on and in the weeds; we trust the operators to understand what drives the financial performance of their business

- Applying a rigid playbook to every company

The Invited Guest Approach is:

- Being abundantly available, not just in board meetings…

- … while acknowledging that the founder and operators know the company infinitely better than an investor board member possibly can

- Being reactive to your needs while proactively thinking about how to add value

- Providing an extensive network of experts and advisors who have navigated growing pains that the company will inevitably experience as it reaches new milestones

- Focusing our efforts on increasing Enterprise Value through initiatives that will lead to valuation multiple expansion

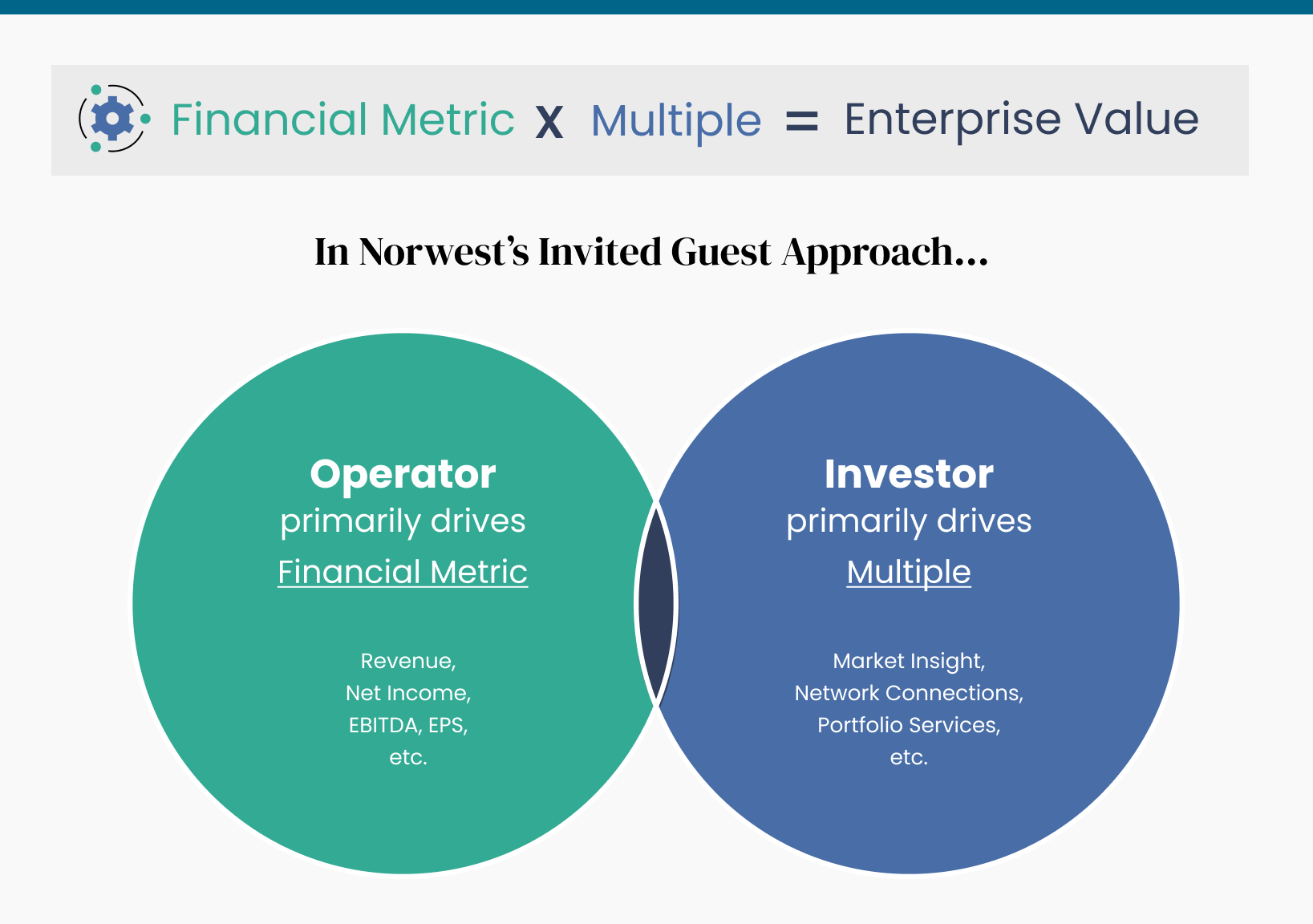

Admittedly, “increasing Enterprise Value through initiatives that will lead to valuation multiple expansion” sounds like the kind of board speak that my former ranching colleagues might roll their eyes at. Here’s a framework I use to further define the concept:

Founders “hire” Norwest to help increase the value of their businesses. In simplest terms, this comes from:

- growing financial metrics (i.e. revenue, EBITDA, cash flow)

- increasing the multiple on those financial metrics, which a potential acquirer might use to value the business in the future

The Invited Guest Approach aims to provide insights and strategy that will maximize valuation multiple while leaving operators the space to focus on executing plans that will achieve that outcome.

Invited Guest in Practice

In reality, operators and investors are both part of the same team. We work on strategy and tactics together. Norwest can certainly provide operational insights, such as an effective M&A playbook, managing working capital, and launching new advertising channels. However, we’re most effective identifying specific strategies that will increase the valuation an investor or acquirer might pay for the business. We do this by focusing on activities like:

- Being acutely aware of similar transactions in the market and what factors contributed to the valuations paid by acquirers

- Identifying and mitigating existential risks to the business

- Finding the optimal balance between growth and profitability

- Making key business development introductions

- Helping operators understand what metrics are important for driving enterprise value (e.g., a 10% growth acceleration should lead to X increase in multiple)

- Introducing operating advisors and independent board members who have scaled businesses through the phase of growth that our portfolio company is about to experience

- Leveraging our Talent & People team to make key executive hires and design appropriate compensation structures (e.g., understanding a typical fixed vs. variable compensation split for sales executives)

- Increasing the visibility of our companies in financial markets

You may be thinking, “This all sounds great in theory but can you give me some specific examples?”

I’m glad you asked. We’re proud to have delivered Enterprise Value to many portfolio companies over the years by applying the Invited Guest Approach, including:

- Providing best-in-class benchmarks for specific value-driving financial metrics and ratios (i.e. gross margin, LTV/CAC, revenue per sales team member)

- Helping MAËLYS fortify its relationship with key retailers by making executive-level introductions

- Aligning on a product expansion strategy with MTN OPS that focuses on growing segments of the supplements sector

- Partnering with SmartSign management to execute a verticalization strategy

- Narrowing Lyra Collective’s acquisition strategy

- Sourcing and vetting talent for Vuori’s management team as the company scaled

- Sourcing and executing on selective M&A to expand Cority’s product portfolio and TAM

- Helping Supplier.io conduct strategic market research into a new industry to evaluate benefits and risks of entering it

The above list is certainly not comprehensive. We aim to be a true thought partner for our founders and operators across all aspects of the business. Then, importantly, we allow the team to go execute!

Now you may be thinking, “The Invited Guest approach resonates with me. When and how does Norwest get involved?”

We thrive working with founders and operators seeking a partner that follows this Invited Guest mentality. We’re often investing in companies at an important inflection point: shifting from pure financial growth to increasing Enterprise Value. We’re comfortable investing in either a minority or majority position. If you’re interested in learning more, please reach out. We’d love to elaborate!

I know you’ve been wondering, “So… what happened to the bison?!”

After a full-day exhaustive search, the ranch hands intercepted the missing bison, corralled them from horseback, and ushered them back to safety. Crisis averted.