If you’re a people leader who’s prepped for a board meeting and felt a mix of excitement, nerves, and/or dread… you’re not alone. In my experience advising HR professionals across private and public companies, board prep always carries weight. But it also holds real opportunity—because when you connect the dots between people strategy and business outcomes, you help the board make decisions that move the company forward.

As part of our ongoing roundtable series, we gathered people leaders from across our portfolio to talk about working with boards—how to demystify the process and own the room (without losing sleep). Our guest speaker, the brilliant Shea Kelly, brought over 30 years of HR and board-level experience, having led people functions across both private and public companies. She offered a fresh take on what boards need most from HR, and how we can show up with confidence and impact.

Here are the biggest takeaways from the conversation.

People Leaders Drive the Board’s Understanding in 3 Key Areas

Shea outlined three lanes where people leaders play a critical role:

- People strategy and risk – Help the board see how emerging trends like AI, remote work, and shifting talent expectations are shaping workforce dynamics and business risk.

- Talent, skills, and sustainability – Offer visibility into how the company attracts, develops, and retains key talent. Think compensation, succession planning, and closing skill gaps.

- Culture, engagement, and productivity – Create a connection between how people feel at work and how the company performs.

These conversations bring humanity into the boardroom and help the board make better decisions.

Boards Need Human Capital Data That Tells a Story

Boards aren’t in the weeds. It’s your job to provide a clear window into the health, risks, and potential of the workforce. And that starts with actionable, strategic human capital data for both private and public boards (more on this in a minute).

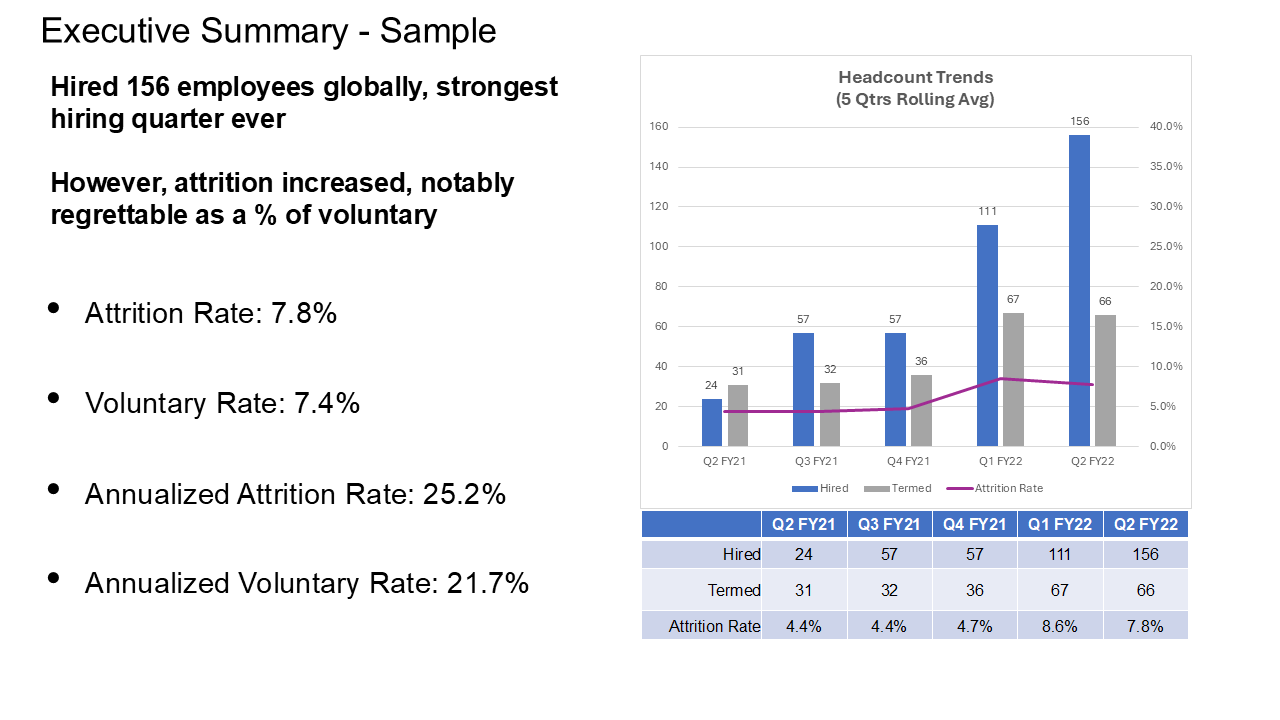

Shea emphasized the power of storytelling: “Use data to tell a story.” What are the trends? What needs attention? What’s going well?

Metrics that matter include:

-

- Workforce composition and demographics, hiring and recruiting statistics

- Workforce trends, including regrettable attrition rate

- Survey data on engagement, clarity of purpose, and connection to the mission

For example, you could discover higher attrition among women in their first six months than their male counterparts, requiring further investigation. Or you may discover an increase in voluntary attrition among critical talent that could signal underlying issues with engagement or organizational effectiveness.

Your voiceover matters in contextualizing the data and communicating the business implications.

And remember: visuals help. Simple dashboards or consistent report formats make it easier for the board to digest key information.

Understand the Board’s Lens—Private vs. Public

What your board wants to see (and what they care about most) depends on where your company is in its journey.

In a private company, the investors typically set the board’s tone—they have skin in the game. Dynamics can change depending on the makeup of the board.

For public companies, that’s where independent directors enter the mix—often with deep functional chops. Think: a former or sitting CTO joining a newly public tech company. Know who’s in the room and tailor your message accordingly.

Even if you’re not going public tomorrow, Shea recommends adopting public-ready practices now to uncover any gaps:

-

- Ensure compensation plans, both cash and equity, are market-based and well-documented

- Partner with your external comp consultants early

- Get crisp on equity allocation guidelines and burn rates

- Know your comp philosophy and implementation guidelines (e.g., equity, cash, bonus/STI plans) and be ready to explain it

Evaluating Executive Talent (and Sharing Assessments with the Board)

Executive succession planning and performance evaluations are essential for both private and public companies.

Shea has created color-coded dashboards to communicate executives’ value to the organization across performance and potential, and to highlight risks and opportunities.

Executive succession planning and performance evaluations are essential for both private and public companies.

Boards want to know:

-

- What will executive roles require in two years?

- Do current executives have the capacity to take on more as the company grows?

- Do we understand the potential for flight risk?

- Are there potential internal successors should a role become vacant (ready now, or ready with development)?

- Are critical roles identified, those where vacancy or under-performance are material to company performance?

- Where critical roles have flight risk and no identified successors, what actions should be considered? E.g., compensation adjustment? Strategic hiring for potential successor?

Pro tip: collaborate closely with the CEO to assess the CFO, CTO, and go-to-market leaders in particular.

Compensation Committees Provide the Holistic Talent View for Boards

As Shea said in our conversation, “I never thought executive compensation would take up so much of our time, but it really does—especially if you’re in a public company.”

Thus, it’s key to build strong relationships with the compensation committee’s key partners including the CFO, General Counsel, and external comp consultant.

“I never thought executive compensation would take up so much of our time, but it really does—especially if you’re in a public company.” -Shea Kelly

Together, you’ll support the comp committee in answering critical questions around talent strategy, culture, and risk profile. This could include:

-

- Is compensation appropriate for each level of the workforce and thoughtfully allocated to optimize pay-for-performance?

- Does the company have a clear compensation philosophy that defines its target market positioning to effectively attract and retain key talent in its operating markets?

- Is the company diligently following established equity guidelines?

- What’s the target versus actual annual burn rate for equity? What circumstances would impact that allocation?

- Is the company meeting the needs for hiring and retention without overspending?

And always, always close with action items. Help the board track what’s working, what needs attention, and what’s next.

Final Thoughts: You’ve Got This

Working with your board doesn’t have to feel intimidating. When you lead with insights, connect the human element to business strategy, and come prepared with clean data and strong partnerships—you become an invaluable voice in the room.