Resources

Blog

Blog

/ Investment

August 7, 2025

Every day, enterprise customer support centers around the world handle thousands of complex inquiries. Customers and the businesses serving them need fast answers to warranty claims, billing disputes, technical issues, and so on.

Each ticket carries the weight of brand reputation and customer lifetime value — and for good reason. Qualtrics found that bad customer experiences could cost organizations $3.7 trillion globally this year alone.

Now imagine a support environment that can spring into action and support all aspects of the customer service workflow. Think about AI agents automating resolution paths, preserving context across every channel, escalating nuanced edge cases, and empowering agents with full historical memory, all while maintaining compliance and SLAs.

This year alone, organizations could lose $3.7 trillion globally due to bad customer experiences. Enterprises need infrastructure that can deploy AI Agents at scale and support all aspects of the customer service workflow.

This future can’t take root without fixing what’s underneath. Historically, the challenge around data sprawl and complex resolution paths has been an untenable problem. Tools aren’t the problem (and can’t be the only solution) when the infrastructure is broken.

Enterprises need infrastructure that can deploy AI Agents at scale with the context, coordination, and compliance that they demand.

And that’s exactly why we’re delighted to announce our investment in Kustomer, which is making this concept a reality.

From Ticketing System to System of Action

Customer support is undergoing a foundational shift. The rise of LLMs, agentic platforms, and multimodal interfaces has made it easier than ever to build support agents. But most enterprises are running into the same wall: their underlying CRM or system of record wasn’t built for this new world.

Customer support teams are trapped in what Kustomer calls the “frankenstack”: a patchwork of legacy systems that fragments customer data, frustrates agents, creates a lackluster customer experience, and makes AI deployment nearly impossible at enterprise scale.

Modern AI workflows require:

- Persistent memory across interactions

- Agentic coordination across bots, humans, and systems

- Workflow adaptability in dynamic and regulated environments

While newer AI-powered tools are making impressive strides, true intelligence, coordination, and proactivity require deep integration with the system of record — something that’s hard to retrofit.

That’s where Kustomer stands apart.

The Operating System for AI-Native Support

Rather than building another AI agent or bolting AI onto existing infrastructure, Kustomer recognized that the future of customer support requires a completely different foundation.

Kustomer is built on a modern CRM platform that combines a deeply robust system of record with multi-agent architecture built in. It acts as a context engine, routing layer, and decision-making substrate that promotes the human-AI model to ensure seamless collaboration.

Kustomer is built on a modern CRM platform that combines a deeply robust system of record with multi-agent architecture built in.

Why it matters:

- Natively supports AI workflows: Agent memory, context injection, and fallback logic are core features.

- Enterprise-grade scalability: Kustomer is already used by brands like Skims, Priceline, and Untuckit.

- Built for extensibility: Open architecture and developer-first APIs make it a hub for emerging AI tooling.

In other words, Kustomer is the control center for next-gen support teams. Where the system of record is natively interwoven with the system of intelligence and action.

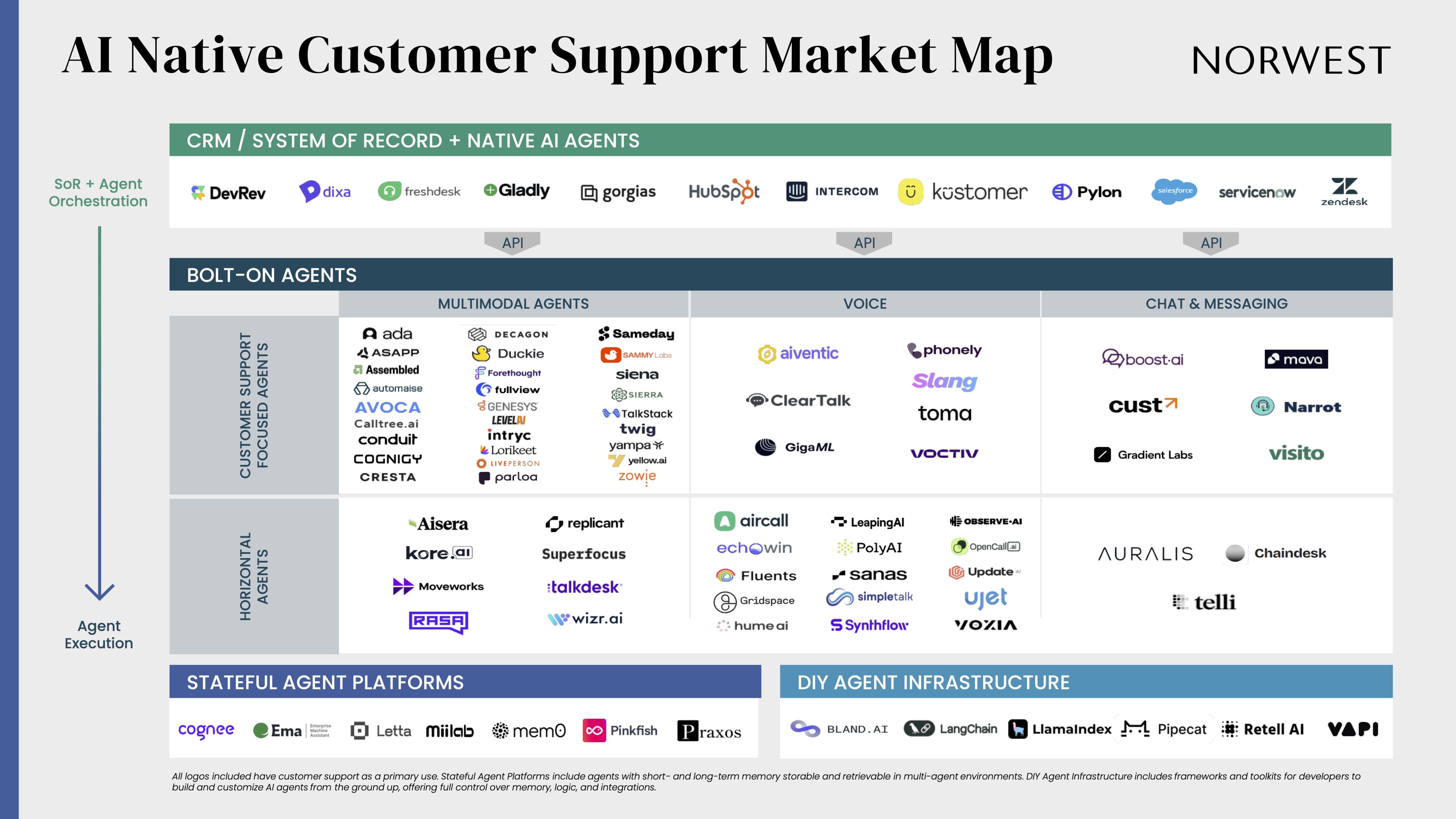

The Evolving AI Customer Support Landscape

We’ve spent months studying the current market and years investing and building across CRM and Customer Support broadly. The AI customer support stack has exploded with innovation across:

- Multimodal agents

- Voice specific agents

- DIY agent infrastructure

There’s been an uptick in AI-only solutions that market sleek interfaces and fast response times. But, as the hype settles in the market, our belief holds steady: agentic platforms with a native system of record will accrue the most value in this next wave of CX innovation.

Without deep customer context, cross-channel memory, and orchestration logic, AI agents will hit a ceiling. Platforms not architected to evolve into intelligent, proactive systems will face mounting complexity as automation layers scale. Their usefulness will wane, and enterprises will be back where they started: with less-than-satisfactory experiences.

Think of a customer escalating a warranty issue over chat, then following up by phone days later while referencing a past billing error and a missed service appointment. Even a stateful agent trained on recent interactions would struggle to resolve this without access to the full historical context—purchase records, support logs, billing data, and case notes — stored in the system of record. It’s this deeply integrated, longitudinal view that enables true resolution, not just intelligent conversation. New integration paradigms like Model Context Protocol (MCP) will help bridge some of these gaps, but systems of record for complex CX analytics and workflows will reign supreme for some time.

We believe Kustomer is uniquely positioned to serve as the infrastructure layer for this new era of support.

What Comes Next

We’re at the beginning of a transformative 10 to 20-year technology cycle that’s larger — yes, larger — than the internet’s widespread emergence in 1994. We’re at the precipice of a new industrial revolution. What the loom was to textile production, AI is to SaaS companies.

While most teams are still trying to force AI innovations through systems designed for a pre-AI world, Kustomer is purpose-built to meet this moment today.

Standing up a truly robust, modern system of record takes time and deep product investment. Kustomer has spent years building the foundation for intelligent, orchestrated support—and we believe that will pay dividends as enterprise AI maturity accelerates.

Kustomer has spent years building the foundation for intelligent, orchestrated support—and we believe that will pay dividends as enterprise AI maturity accelerates.

We couldn’t be more excited to partner with Brad, Jeremy, and the Kustomer team to support their vision of AI-native, context-rich customer service.

If you’re building in this space or want to trade notes on the future of customer support, reach out — we’d love to hear from you.